See Bench Fi in Action

Explore the key features that make Bench Fi the ultimate financial benchmarking platform

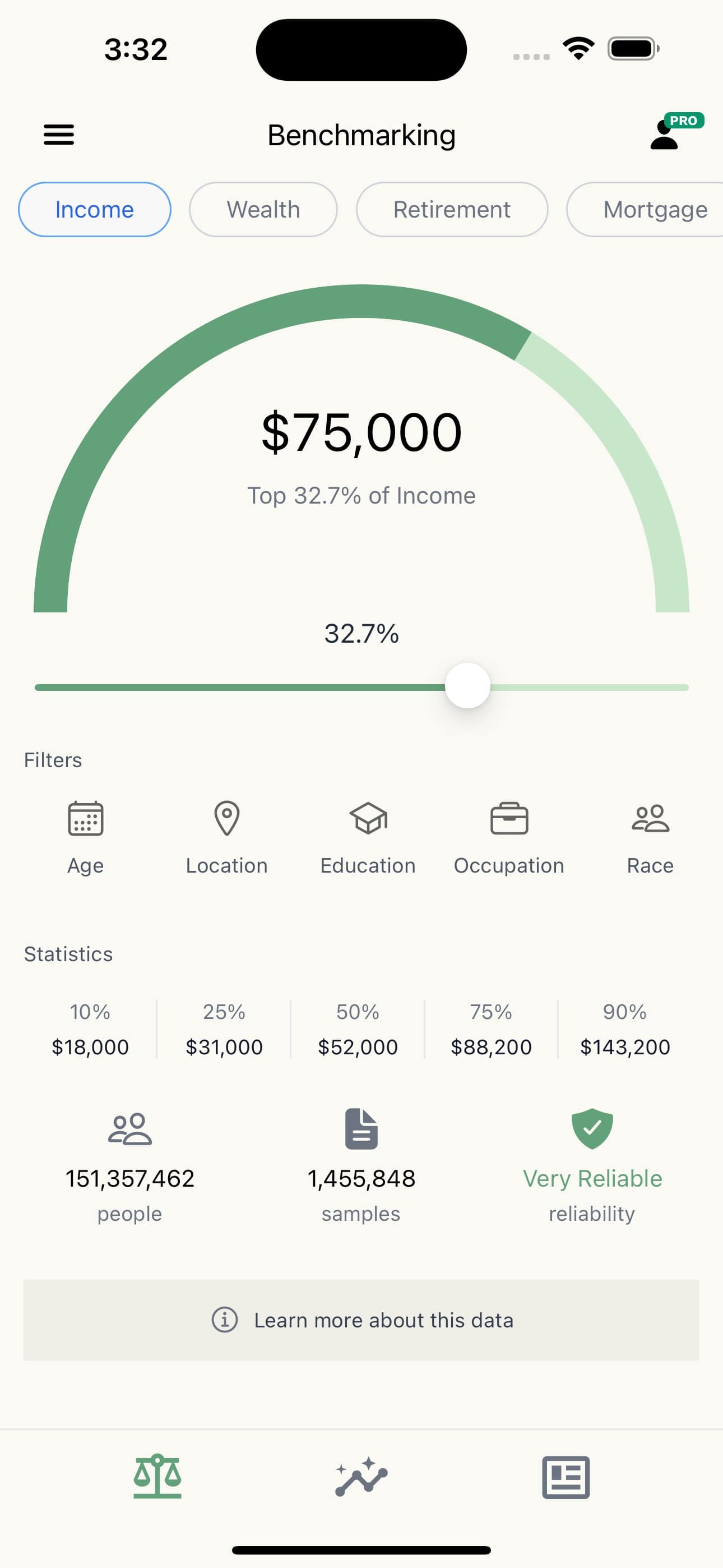

Comparative Analytics

See how you stack up against peers in your age, income, and location. Get real-time benchmarking data that helps you understand where you stand financially.

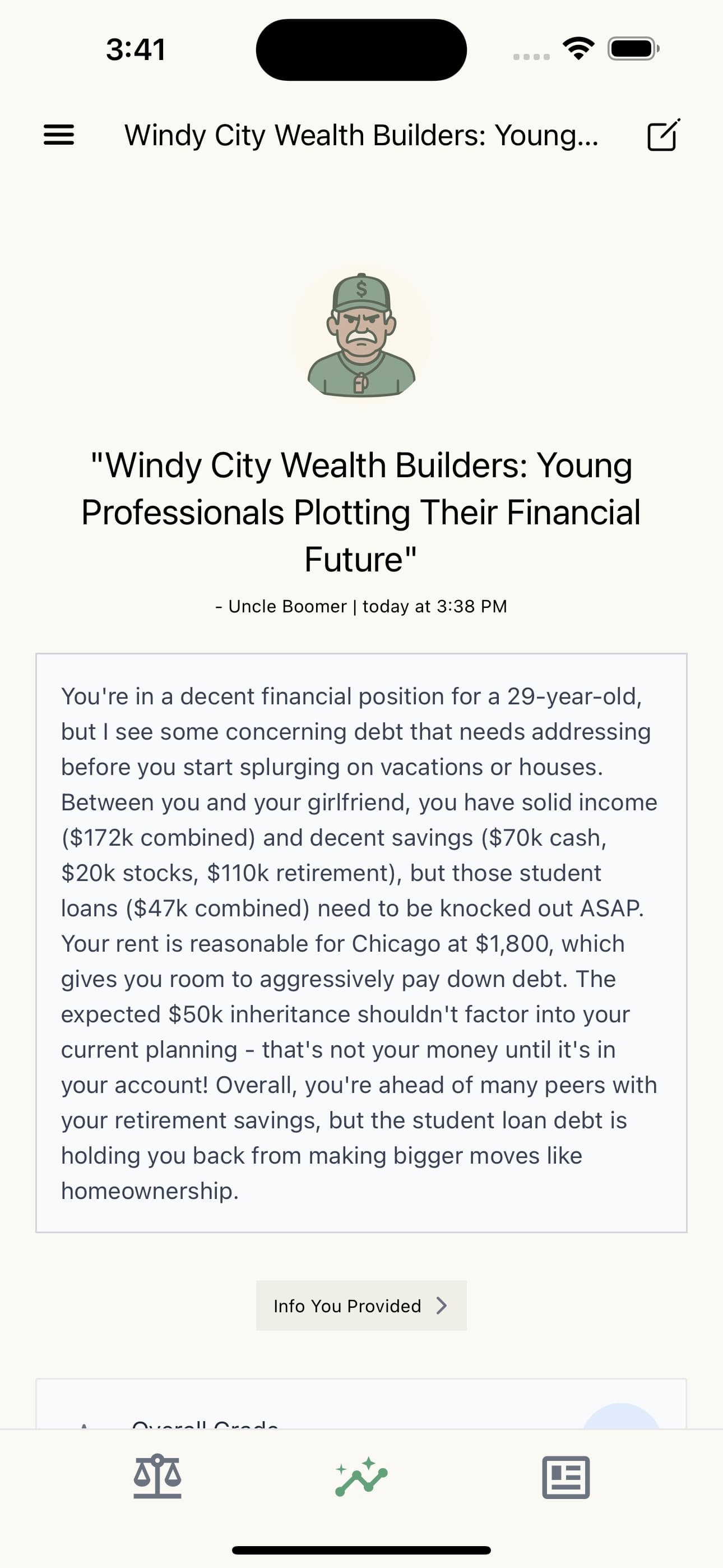

AI-Powered Insights

Get personalized recommendations based on your financial profile. Our AI analyzes your financial details and provides actionable insights to improve your financial health.

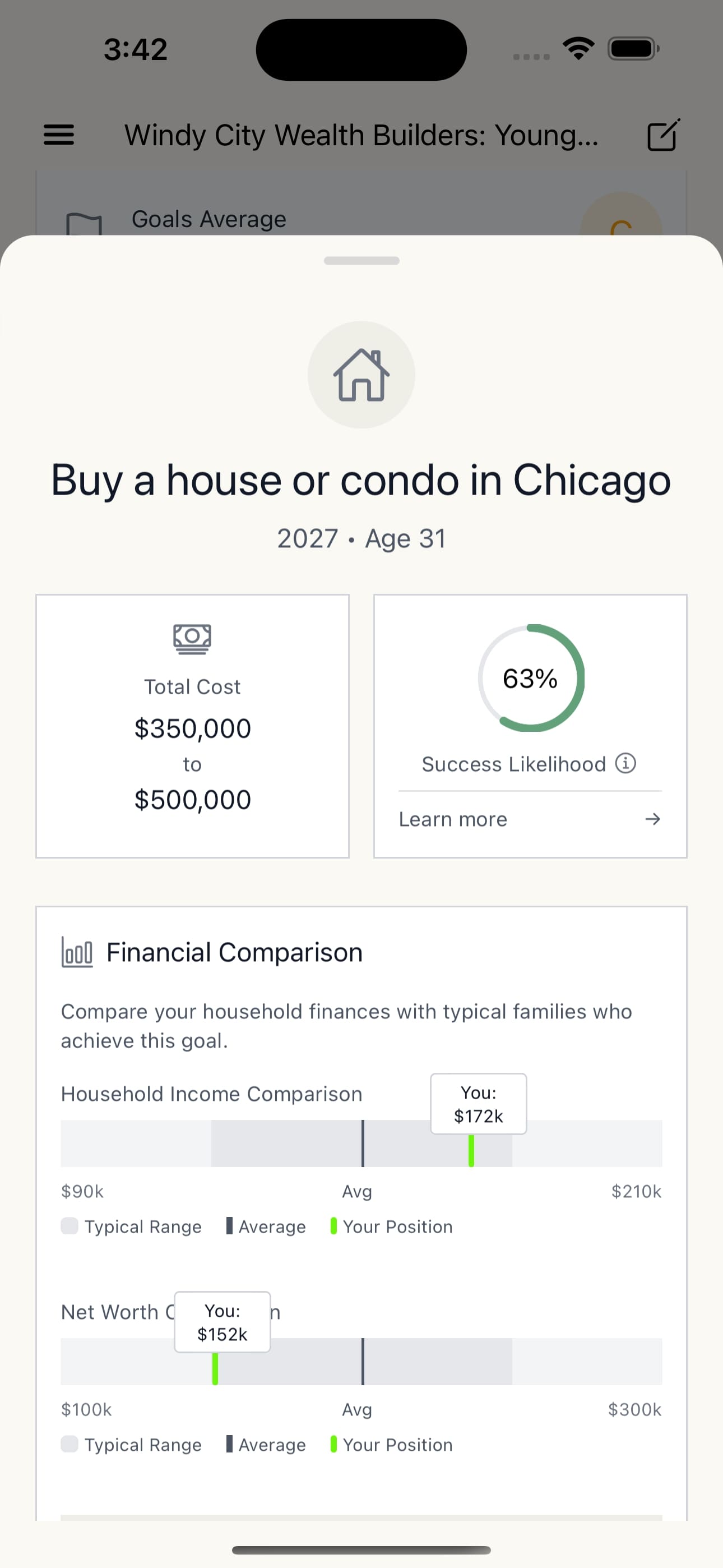

Goal Tracking

Set goals and get a personalized assessment of your chances of achieving them. Whether it's buying a house, saving for retirement, or building an emergency fund, we'll help you know where you stand, what is possible, and what you need to do to achieve your goals.

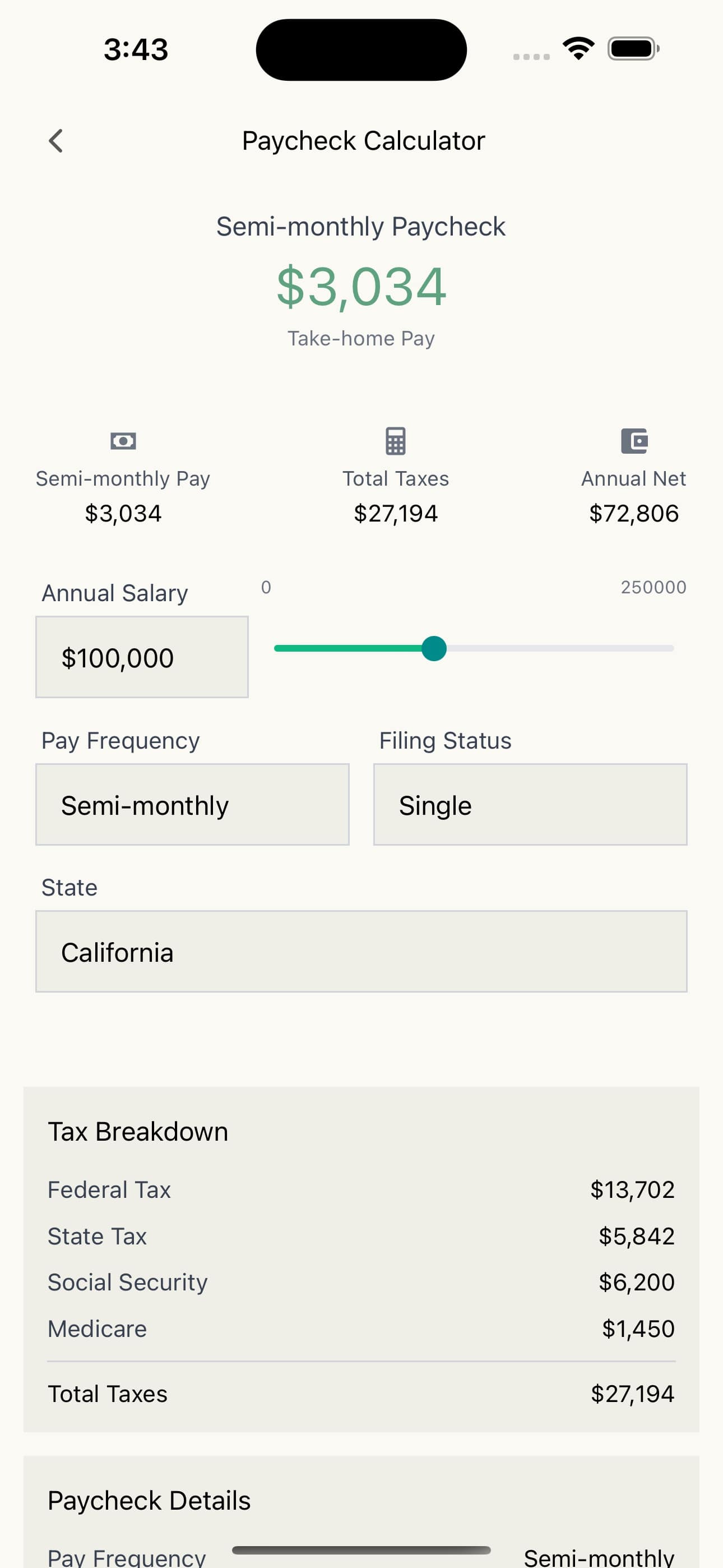

Advanced Calculators

Advanced tools for mortgage, investment, and retirement planning. Make informed financial decisions with our comprehensive suite of calculators.

Meet Your AI Financial Coaches

Get personalized financial guidance from AI coaches tailored to your style and goals. Each coach has their own personality and approach to help you succeed.

Uncle Boomer

Savvy Sarah

Middle Mike

Aunt Carol

Big-Time Bob

Fast Eddie

Uncle Boomer

High Credit Card Debt

"Listen kiddo, that credit card debt is eating you alive! Cut up those cards right now and pay cash for everything. Sell that fancy car if you have to - debt is the enemy of wealth!"

Savvy Sarah

Emergency Fund Goal

"You're doing great building that emergency fund! Try the 'pay yourself first' method - automate $200 to savings right when you get paid. You won't even miss it, and you'll hit your goal faster!"

Middle Mike

Investment Strategy

"A balanced approach works best here. Put 60% in index funds, 30% in bonds, and 10% in individual stocks you believe in. Steady growth over time beats trying to time the market."

Download The App

Get the Bench app to unlock powerful financial insights and personalized coaching.

AI Coach Reports

per month

- • Personalized financial coaching

- • Strategic optimization recommendations

- • Monthly insights and analysis

- • Custom action plans

Unlimited Access

included

- • All benchmark comparisons

- • Financial planning calculators

- • Progress tracking tools

- • Industry performance metrics

Privacy & Security

private

- • All AI reports are completely private

- • Your data is never sold to third parties

- • Only used for personalized insights

- • Secure financial product recommendations

Latest from Bench Press

Stay informed with our latest insights on personal finance, investing, and building wealth

Financial Calculators

Use our comprehensive suite of financial calculators to make informed decisions about your money